What Taxes or Other Fees Does Your Family Pay to Support Your Local Government?

12b. Financing State and Local Government

Completed in 2007, Boston's Central Artery/Tunnel Project — a.k.a. the "Big Dig" — was the largest, about complex, and most technologically challenging highway project in the U.S. Financing came from a combination of federal, state, and local funds.

Paying taxes is surely everyone's least favorite government-related activeness. But taxing citizens is one of the concurrent powers of authorities. Federal, state, and local levels all have the power to tax.

Of class, people wait state and local governments to provide services such as police protection, educational activity, highway building and maintenance, welfare programs, and hospital and health intendance. Taxes are a major source of income to pay for these services and many others that hit close to home. For most people, their local and land tax money pays for very visible services that they by and large have for granted, except when something goes wrong with garbage drove, traffic lights, or snow removal. People are most probable to become involved with local and land governments when these basic services get incorrect.

Expenses

The single biggest expenditure in all states is education, with the boilerplate state and the localities within it spending just less than 1-quarter of its budget for public schools. Funding for education comes primarily from the local school commune budget, but most country governments give a slap-up deal of financial and authoritative support to schools. Other large budget items for state and local governments are the following:

- Public welfare

- Health care

- Highways

- Constabulary and burn down protection

- Involvement on debt

- Utilities and liquor stores

What would you practise if there was a revenue enhancement that didn't provide for the basic needs and services of your local area, and instead went to some monarch on another continent? Early American colonists had an answer. This cartoon from 1774 reads: "The Bostonians paying the excise-man or tarring and feathering."

Each of these items is less than 10% of state and local expenditures in most states, but together they make up a expert portion of the expenses.

Income

Counties, townships, cities, and states collect some of their money from licenses and fees and land-operated businesses, simply about half of state revenue comes from taxes. 2 other sources of income are grants from the federal government and, in some states, lotteries. About states and localities levy 3 types of taxes:

- Sales taxes are the most important source of acquirement for states. Information technology is placed on various products, and customers pay the tax when they purchase them. Today 45 states have a general sales tax that applies to most goods, although food is normally excluded, and sometimes clothing is exempt. Some cities too collect sales tax.

- Income taxes are imposed by all only a handful of states on personal and corporate incomes. Personal income taxes are generally progressive; that is, they are graduated and so that the rate goes up with the size of the income. States generally do not allow local governments to levy income taxes, simply some municipalities impose a payroll taxation on people that work within their borders.

- Property taxes provide the primary source of income for local governments today. Taxes are levied on land, buildings, and personal dwellings. Belongings must be assessed for its value, and most cities apply revenue enhancement assessors for that chore. Property taxes are controversial because other types of property, such every bit stocks, bonds, and banking company accounts, generally are not taxed. Those who hold "real" property, and then, pay a disproportionate share of the taxes.

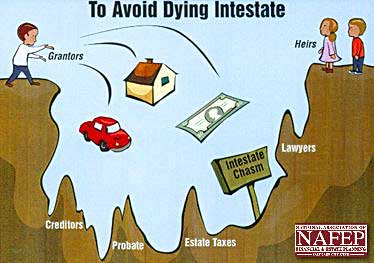

You've heard about "expiry and taxes" simply this is a double whammy: if a person dies "intestate" — without having created a will or trust for his or her heirs — both federal and state governments are poised to accept a hefty chunk of that person's estate by imposing inheritance and estate taxes.

Other taxes include inheritance and estate taxes imposed when a person dies and wills holding to heirs. Several states have severance taxes, levied on those that extract natural resources such equally coal, oil, timber, and gas from the land. Virtually all states identify special excise taxes on gasoline, liquor, automobiles, and cigarettes.

Nearly states become more than than a quarter of their income from federal grants that usually come with restrictions as to how the coin can be used. Federal grants often go for building projects, such as roads, bridges, and dams, and for pedagogy, health intendance, and welfare.

In 1964, the New Hampshire Legislature created the first legal state lottery of the 20th century. Here, the first ticket is sold to Governor John W. Male monarch.

In recent years more and more states have turned to lotteries to pay their expenses. Billions of dollars now come from lotteries, with states retaining nigh one-third of the coin equally proceeds. Some states designate that the money be spent on something special, such as education, the arts, or building projects. Lotteries are controversial because some people believe that lotteries injure lower-income people, who purchase most of the tickets.

Taxes, federal grants, fees, licenses, and lotteries back up land and local budgets. Most people understand more than almost where their country and local taxes and fees get than they practice about federal expenditures. Perhaps that is considering land and local services tend to affect their personal lives more directly. However, many mutter that they do not become their money's worth. Information technology is e'er easier to recognize the pinch that taxes bring than the services most people have for granted.

Source: https://www.ushistory.org/gov/12b.asp

0 Response to "What Taxes or Other Fees Does Your Family Pay to Support Your Local Government?"

Post a Comment